gst cash payout 2022

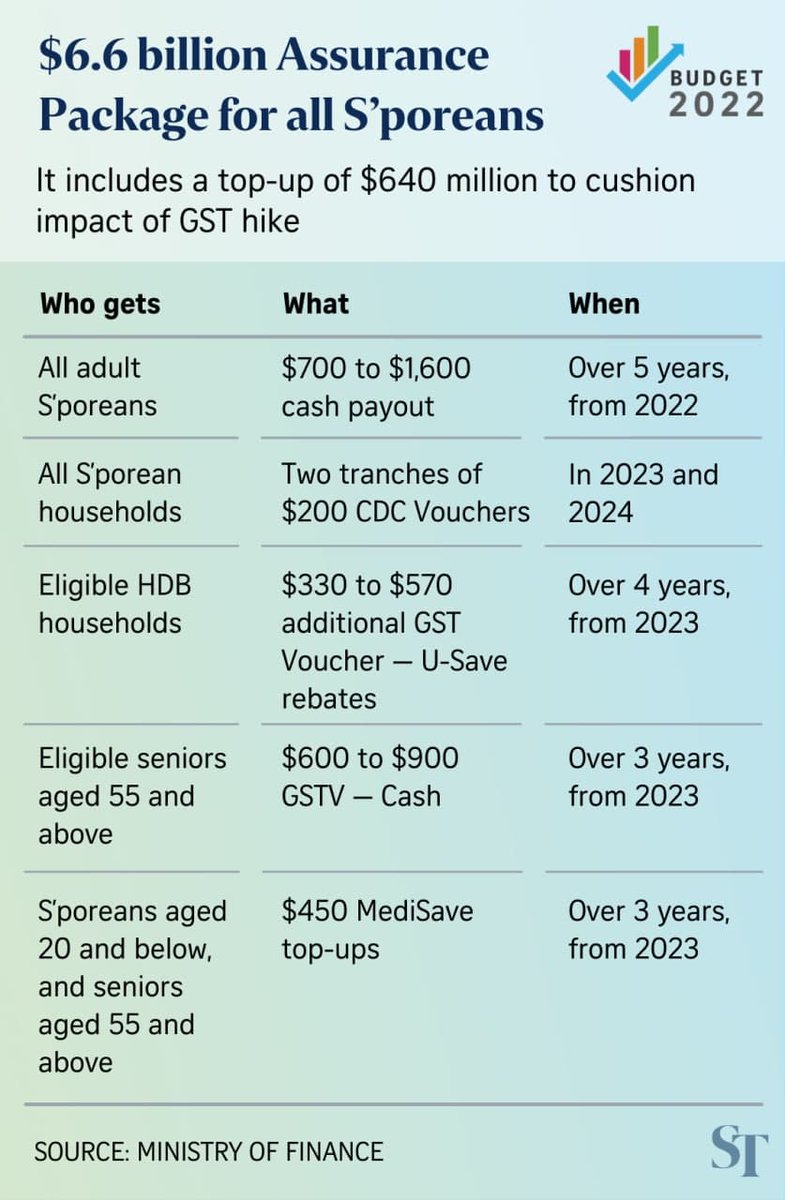

The Canada Revenue Agency will pay out the GSTHST credit for 2022 on these due dates. All adult Singaporeans will receive cash payouts of between 700 to 1600 over five years from 2022 to 2026.

Read next - Budget 2022 highlights.

. 33 How can I update my mode of payment for GST Voucher Cash. January 5 2022 April 5 2022 July 5 2022 October 5 2022 You can receive your payments via direct deposit to your Canadian bank account. S330 to S570 additional GST Voucher GSTV U-Save rebates.

36 My mobile number is already registered to my bank account on PayNow. 23 hours agoPayout period. If youd like to view your benefit information and amounts you can do so using the CRA My Account Service.

The finance bill 2022 was also announced the same day that listed key changes in GST that can significantly impact taxpayers and business owners across all spheres. A AP Cash Payouts Every Singaporean aged 21 years and above will receive cash payouts amounting to between 700 to 1600 depending on hisher income and property ownership see Table 1. Five years from 2022.

GST Registered taxpayers would be eligible to transfer their surplus E-Cash Ledger. The first payout will be made in December 2022. GSTHST credits or payments are made four times per year in equal instalments.

Those with annual income of between S34000 and S100000 will get S1050. The payment date of your GST Voucher will depend on when you signed up and your payment mode. GST cash voucher payouts under the scheme will go up to between 250 and 500 with the exact amount depending on the value of ones home.

The payments are paid out according to a July-June calendar and based on your previous years income. For the 2020 base year payment period is between July 2021 June 2022. 18 during his budget 2022 speechthis is part of a s66 billion assurance package that aims to offset the increase in expenses from the gst hike also announced in the same.

Max payment you can receive. He went on to detail the various measures the Government will take to help Singaporeans especially the less well-off cope with the change. The current payout is between 150 to 300 and is.

1 day agoFirstly GST voucher cash payouts will go up starting this year to between 250 and 500 with the amount depending on the value of ones home. 35 How do I link my NRIC to PayNow. Anyone who qualifies to receive these payments can expect to receive the GSTHST payments for 2022 on these dates.

598year total for both. Can the government credit the GST Voucher Cash to me via PayNow-Mobile instead. 1 day agoAll adult Singaporeans will each get a cash payout of between S700 to S1600 over five years starting from this year Finance Minister Lawrence Wong announced today Feb.

The total amount they will receive will range from S700. GST Notifications which come into effect from 1 st January2022. Feb 19 2022 Two programmes have been put in place to cushion the blow for ordinary Singaporeans.

Extension of period for issuance of credit note along with the rectification of outward supplies already reported by a taxable person. GST law provides for issuance of credit note in case of excess payment of tax rejection or return etc. Supply of goods by any unincorporated association or body of persons to a member thereof for cash deferred payment or other valuable consideration.

Earlier the time limit was up to Sept of the next financial year. Govt Proposes for the extension of deadline for claiming ITC. The payouts will be disbursed over five years from 2022 to 2026.

1 day agoFebruary 18 2022 Finance Minister Lawrence Wong announced today February 18 that GST will go up from 7 per cent to 8 per cent on 1 January 2023 and 9 per cent on 1 January 2024. Cash payouts for all Singaporeans All adult Singaporeans will receive cash payouts over the next five years from December 2022 to 2026. 34 What is PayNow.

The next GSTHST payment date occurs on January 5 2022 and then subsequent payments will be made on. For Singaporeans who own a single property or none at all those with annual income of less than S34000 will receive S1600 over the next 5 years. And those with annual income of.

Four years from 2023. The Straits Times SINGAPORE - Between 2023 and 2024 Singapores goods and services tax. Time limit for issuance of such credit note is proposed to be extended to 30 th November of next financial year from the due date of filing the returns.

Two tranches of S200 Community Development Council CDC Vouchers. 18 during his Budget. The 2021 GST Voucher is 30 April 2022.

157year for each child. GST Voucher 2022 payout date GST is a regressive tax which means it disproportionately affects the poor who spend a higher fraction of. Top Changes made under GST Amendments in Budget 2022.

Those with annual income of between 34000 and 100000 will receive 1050. Payment Mode Sign-up Period By 13 June 2021 14 June to 18 July 2021 19 July 2021 to 30 April 2022 Payment Date To be credited to your PayNow-NRIC-linked bank account GST Voucher GST Voucher Cash Special Payment. S700 to S1600 cash payout.

Changes and additions with respect to Input Tax Credit. GST cash voucher payouts under the scheme will go up to either 250 or 500 with the exact amount depending on the value of ones home. GST hike higher.

Singaporeans who own zero or one property with an annual income of less than 34000 will receive 1600 over the next five years. 1 day agoAll adult Singaporeans will receive cash payouts of between S700 to S1600 over 5 years from 2022 to 2026. All adult singaporeans will each get a cash payout of between s700 to s1600 over five years starting from this year finance minister lawrence wong announced today feb.

In this article we discuss the key areas that have seen multiple changes in GST laws and rules. Disbursed in 2023 and 2024. The current payout is either 150 or 300 and is distributed to Singaporeans with annual income of 28000 and below.